47% of manufacturers are allocating 20% or more of their total technology spend on engineering, manufacturing and supply chain systems.

47% of manufacturers are allocating 20% or more of their total technology spend on engineering, manufacturing and supply chain systems.- 32% of manufacturers cite the development of new products and R&D as a top strategic priority this year.

- 41% of manufacturers are pursuing breakthrough advances as their primary strategy for managing innovation.

- Just 14% of manufacturers claim to have complete supplier visibility.

These and other insights are from the 2015 KPMG Global Manufacturing Outlook (GMO) which is available for download here (36 pp., free, no opt-in). KPMG has also provided a summary, Global Manufacturing Outlook 2015: Preparing for battle – Manufacturers get ready for transformation.

This is the 6th edition of KPMG International’s Global Manufacturing Outlook, and is based on interviews with 386 senior manufacturing executives globally. Respondents are from Aerospace and Defense, Automotive, Conglomerates, Life Sciences – Medical Devices, Engineering and Industrial Products and Metals industries. 50% are C-level executives, and a third are from organizations with more than $5B in annual revenue. Please see page 29 of the study for a complete description of the methodology.

Key take-aways from the study include the following:

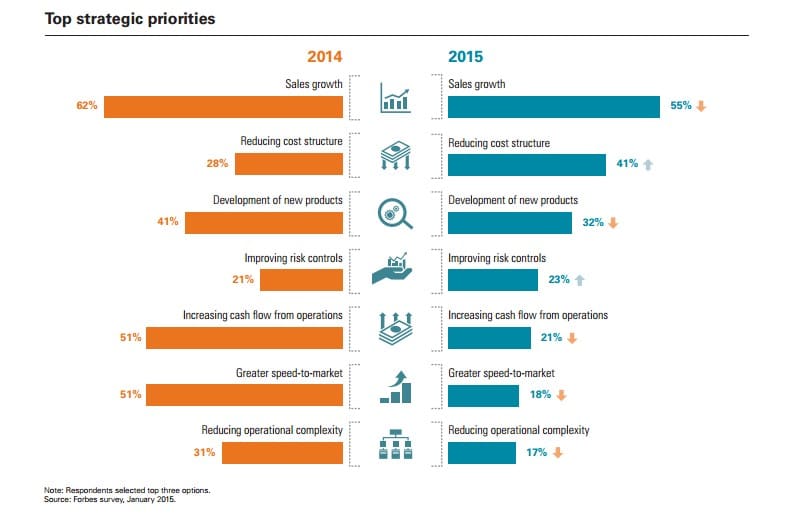

- Sales growth (55%), reducing cost structure (41%) and development of new products (32%) are top three strategic priorities for manufacturers in 2015. Additional priorities include improving risk controls (23%), increasing cash flow from operations (21%), and gaining greater speed-to-market (18%). The following graphic compares the top strategic priorities for 2014 to 2015.

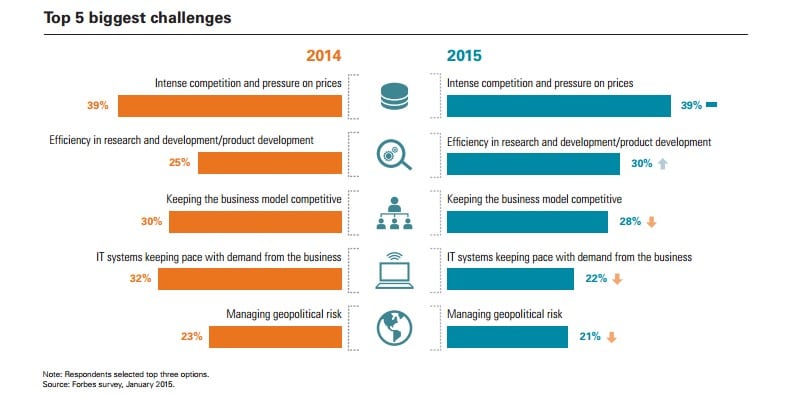

- Intense competition and pressure on prices (39%), efficiency in R&D and product development (30%), and keeping their business models competitive (28%) are the top challenges manufacturers face in 2015. Having IT systems keep pace with demands from the business (and customers) (22%) and managing geopolitical risk (21%) are two additional strategic challenges manufacturers are facing today. The following graphic compares challenges from 2014 and 2015:

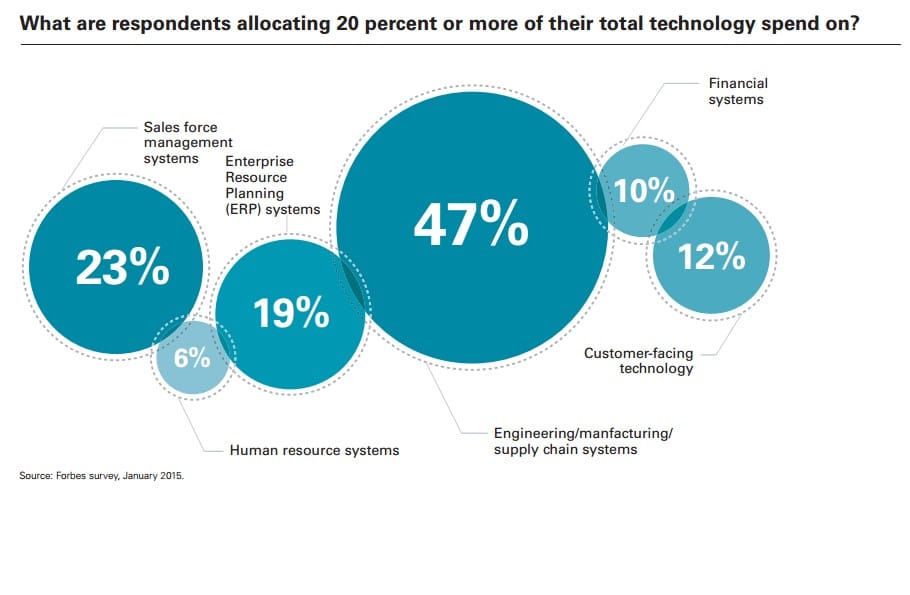

- 47% of manufacturers are allocating 20% or more of their total technology spend on engineering, manufacturing and supply chain systems in the next twelve months. Manufacturers are prioritizing IT investments that drive improvements in the pace and quality of innovation. Investments in engineering, Manufacturing Execution Systems (MES), and supply chain management (SCM) systems continue to accelerate. 23% of manufacturers are investing 20% or more of their IT investments in sales force management systems. The following graphic compares the areas where manufacturers are investing 20% or more of their total technology spend.

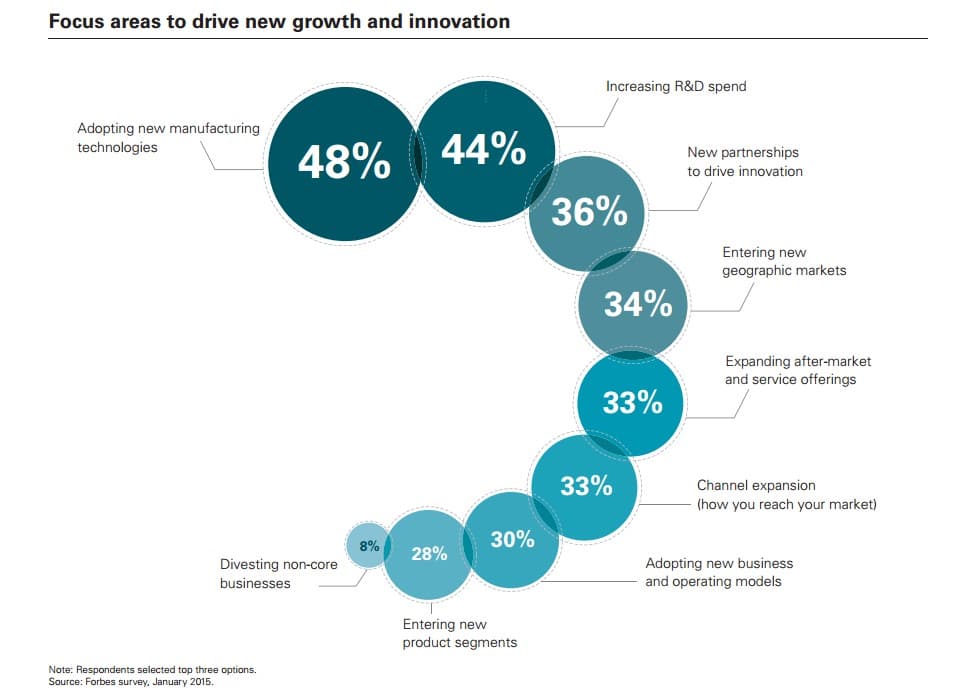

- Adopting new manufacturing technologies (48%), increasing R&D spend (44%), and relying on new partnerships to drive innovation (36%) are the top three strategies manufacturers are using to enable greater innovation. The nascent nature of emerging technologies including big data analytics, cloud computing, 3D printing and nanotechnology in relevant industries are all areas manufacturers are investing in today. The following graphic compares the areas manufacturers are concentrating on the most to drive greater growth and innovation.

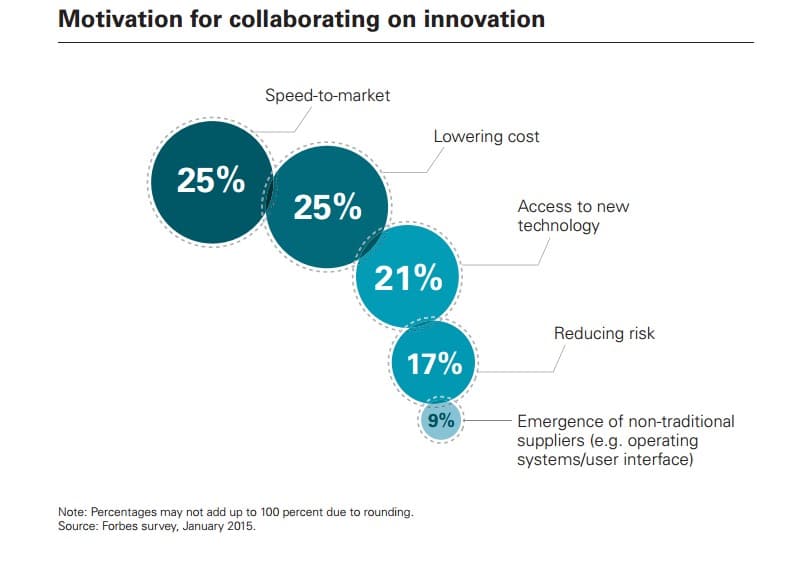

- Improving speed-to-market (25%), lowering cost (25%) and improving access to new technology (21%) are three key factors driving manufacturers to collaborate more on innovation. Manufacturers are challenged with accelerating product lifecycles and the need to continually innovate, while improving production operation efficiency. Managing these diverse challenges requires a strong focus on collaboration. The following graphic provides insights into how manufacturers are collaborating to attain greater innovation.

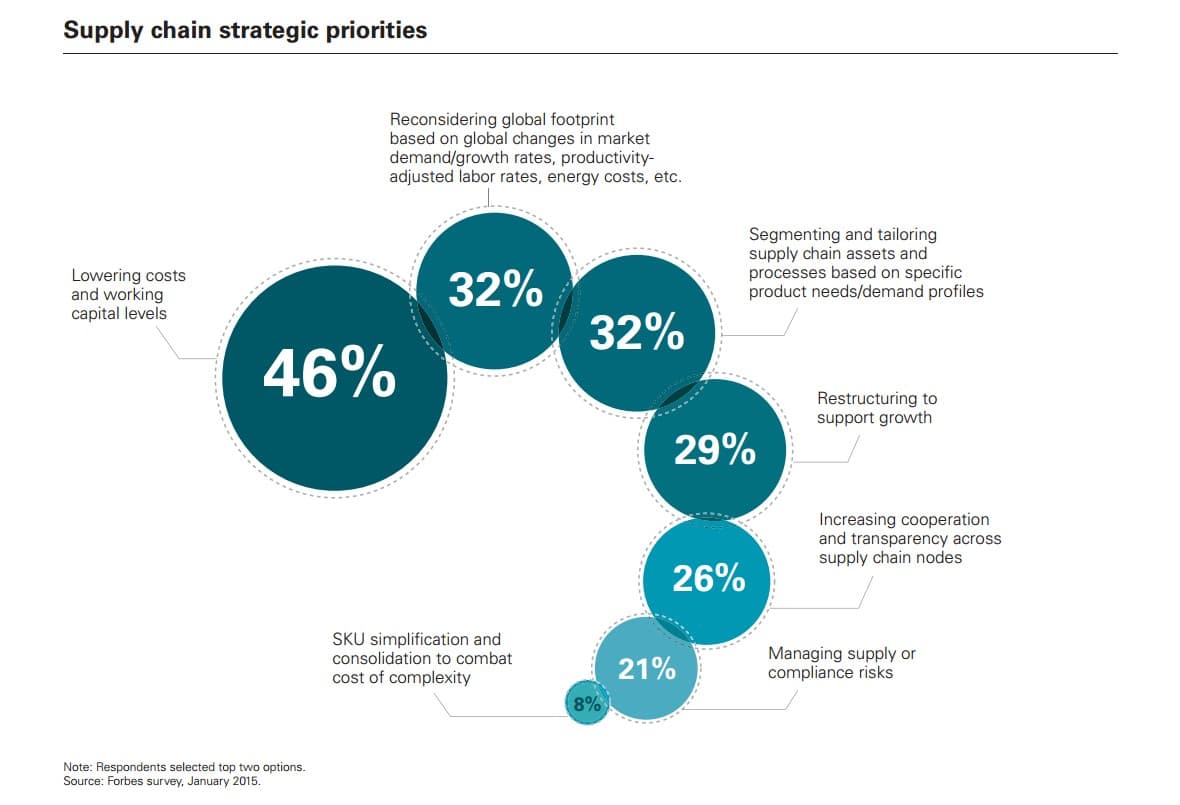

- Lowering costs and working capital levels (46%), reconsidering global footprint of operations (32%), and segmenting & tailoring supply chain assets and processes based on product needs & demand profiles (32%) are the top three supply chain priorities in 2015. Manufacturers are concentrating more on improving demand signal alignment, balancing out their efforts aimed at traditional cost cutting in the past. The following graphic compares strategic supply chain strategic priorities for 2015:

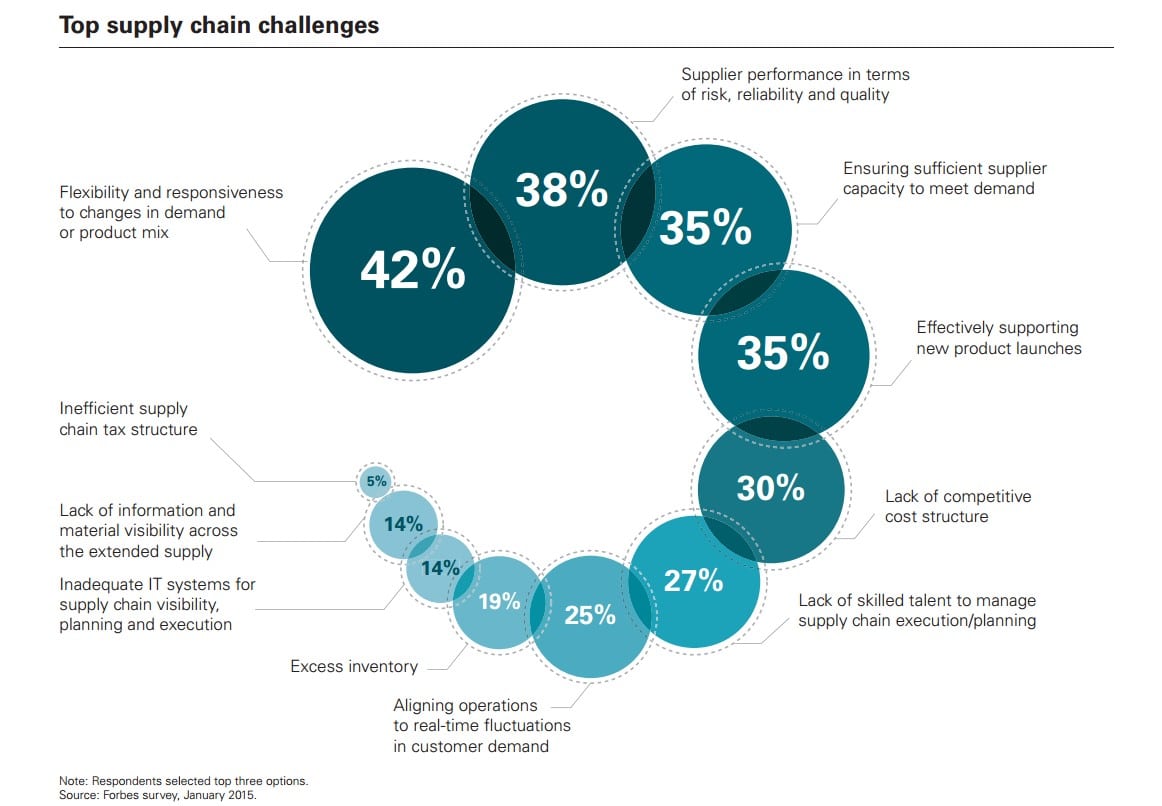

- 42% of manufacturers say that attaining greater flexibility and responsiveness to change in demand or product mix is the top challenge they face with their supply chains today. Additional challenges include managing supplier performance in terms of risk, reliability and quality (38%), ensuring sufficient supplier capacity to meet demand (35%), and more effectively supporting new product introductions (35%). The following graphic compares the top supply chain challenges manufacturers face:

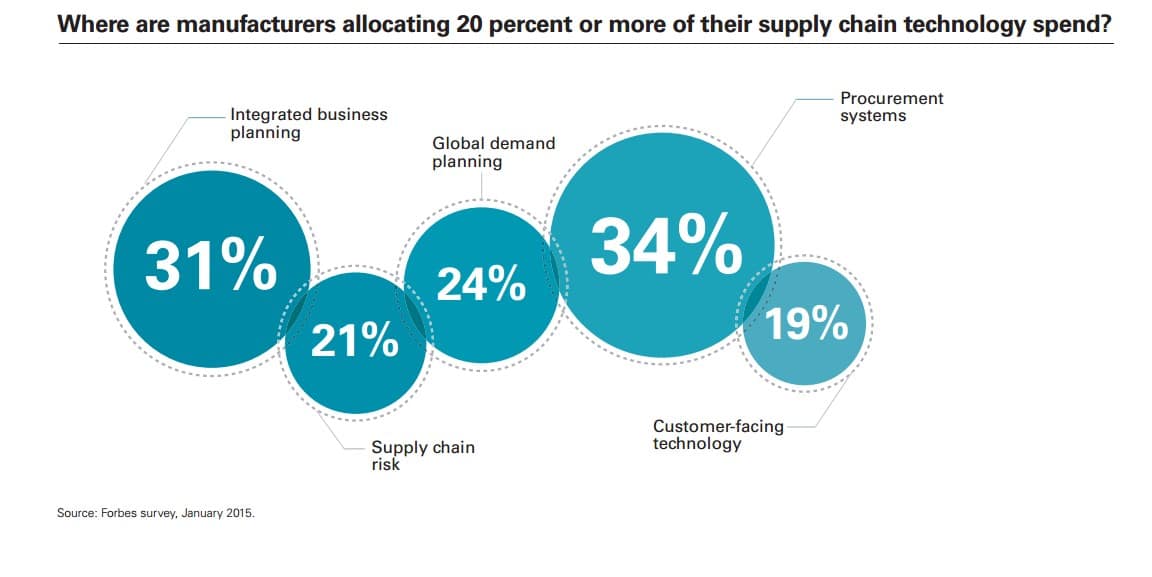

- Procurement systems (34%), integrated business planning (31%) and global demand planning (24%) lead manufacturers’ investment plans for supply chain technologies. The following graphic compares how manufacturers are planning to allocate 20% or more of their supply chain technology spend: