42.6% of all big data manufacturing apps are being created by enterprises today.

42.6% of all big data manufacturing apps are being created by enterprises today.- 38.2% of all big data and advanced analytics apps in use today are in customer-facing departments including marketing, sales, and customer service.

- 33.2% of all big data and advanced analytics developers are concentrating on the software & computing industry.

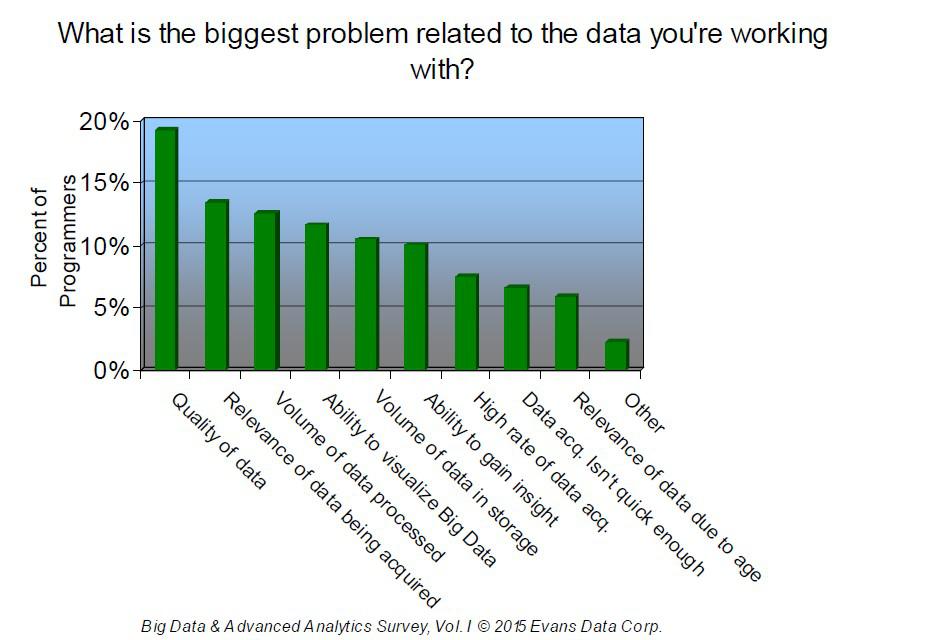

- 19.2% of big data app developers say quality of data is the biggest problem they consistently face when building new apps.

These and other insights are from the recently published report Big Data and Advanced Analytics Survey 2015, Volume I by Evans Data Corporation. The survey is based on 444 in-depth interviews with developers who are currently working with analytics and databases and are both currently working on and planning big data and advanced analytics projects. The survey’s results provide a strategic view of the attitudes, adoption patterns and intentions of developers in relation to big data and analytics. You can more on the methodology of the report here.

Key take-aways from the report include the following:

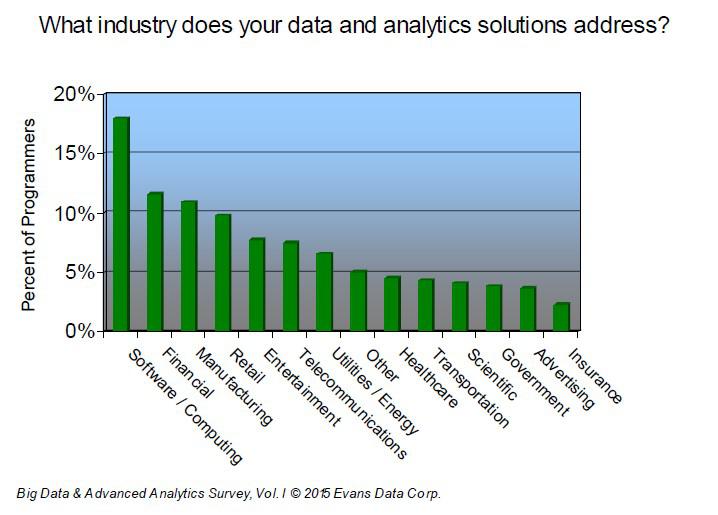

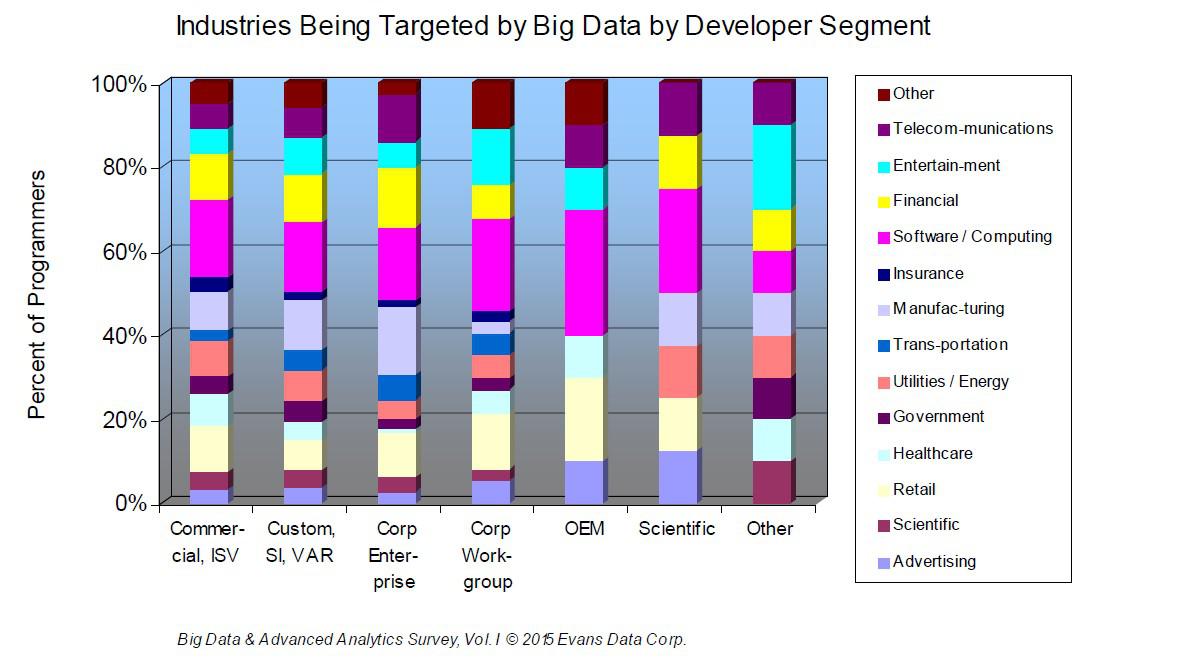

- Software & computing (18%), financial (11.6%), manufacturing (10.9%) and retail (9.8%) industries have the highest percentage of programmers creating big data and analytics applications today. Additional industries where big data app development is active and growing include entertainment (7.7%), telecommunications (7.5%), utilities & energy (6.6%) and healthcare (4.6%). The following graphic provides an overview of the industries addressed.

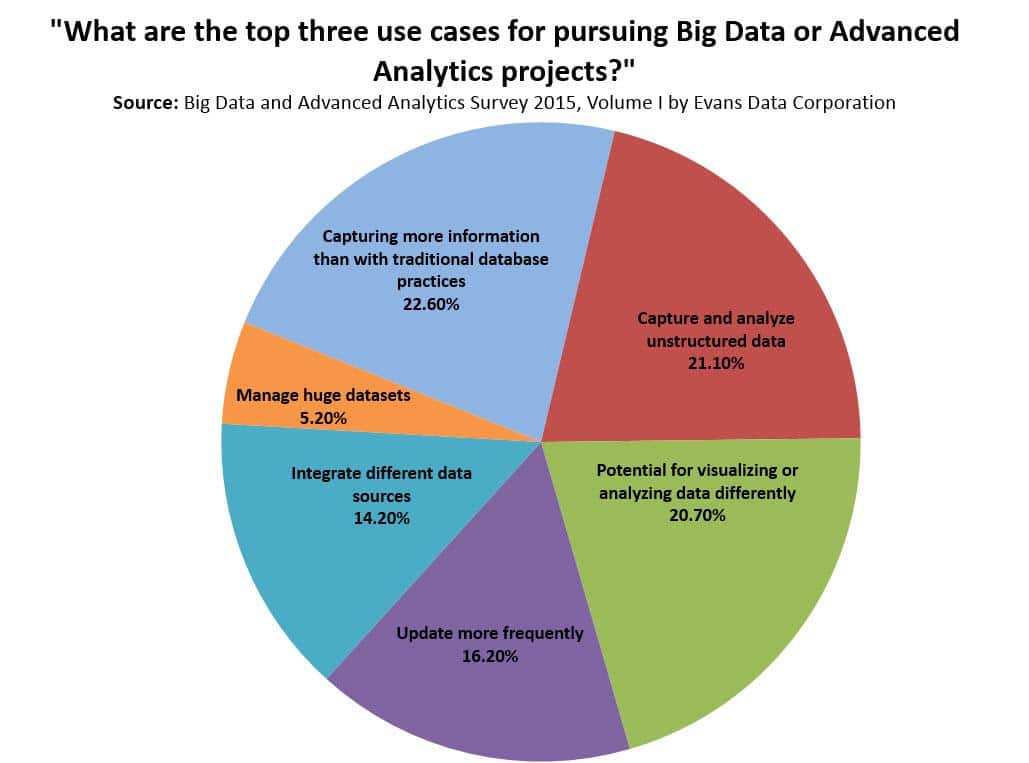

- Capturing more information than traditional database practices (22.60%), capturing and analyzing unstructured data (21.10%) and the potential for visualizing or analyzing data differently (20.70%) are the three top use cases driving app development today. Evans Data found that capturing more information than traditional database practices allow increased 6% since last year, making it the top use case in 2015. The following graphic provides the distribution of responses by use cases from the developers surveyed.

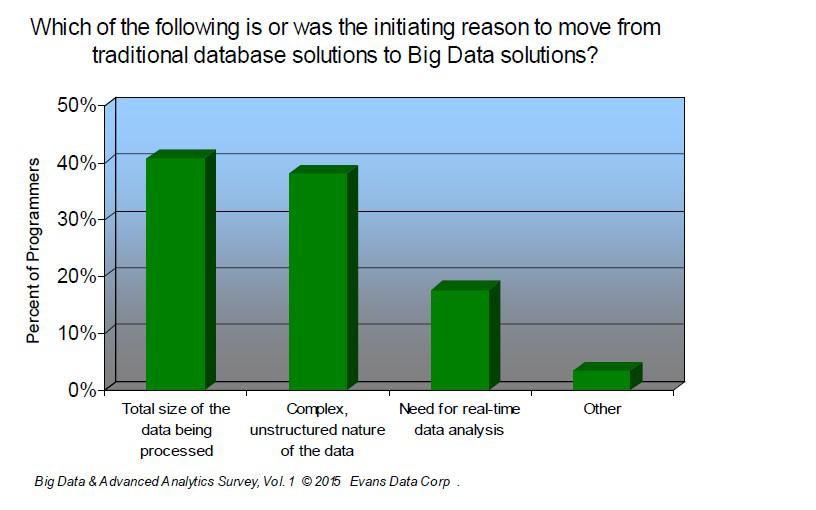

- Total size of the data being processed (40.8%), complex, unstructured nature of the data (38.1%) and the need for real-time data analysis (17.7%) are the top three factors driving big data adoption over traditional database solutions. Evans Data found that the size and complexity of structured and unstructured data is the catalyst that gets enterprises moving on the journey to big data adoption. The ability to gain greater insights into their data with descriptive, predictive and contextually-driven analytics is the fuel that keeps big data adoption moving forward in all companies.

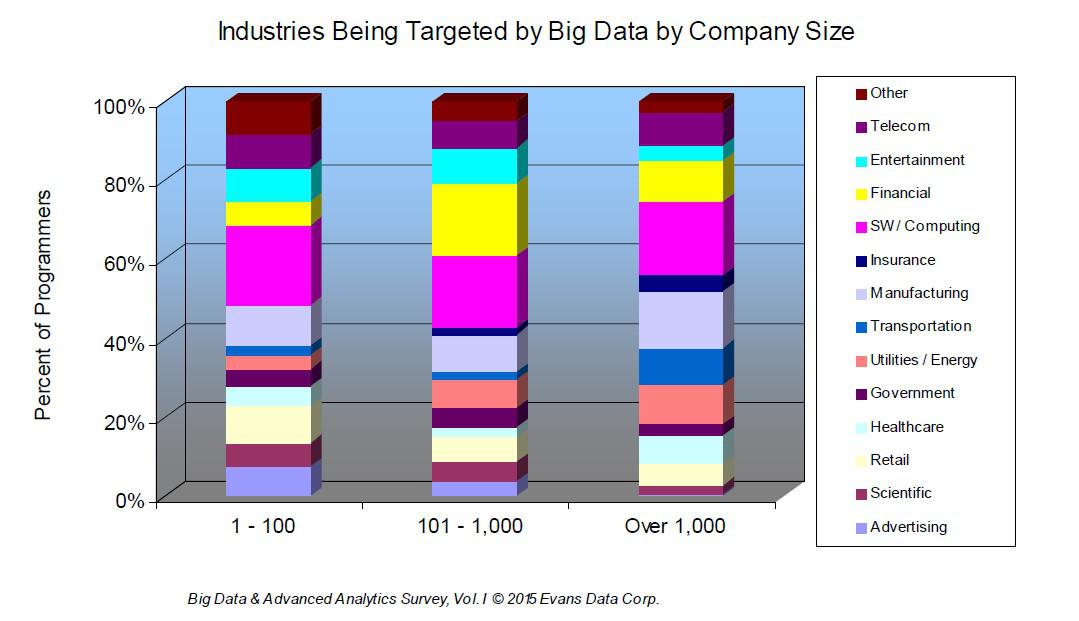

- 33.2% of all big data and advanced analytics developers are concentrating on the software & computing industry. Of these developers, 36.7% are working in organizations of 101 to 1,000 employees, 32.9% are in enterprises of 1,000+ employees, and 30.1% are in organizations of 100 employees or less. 42.6% of all big data software development in manufacturing begins in enterprises (1K+ employees).

- Enterprises competing in the software & computing industry (17.5%), manufacturing (15.8%) and financial industry (14%) are investing the heaviest in big data and analytics app development. Overall, 32% of big data and analytics projects are custom-designed and produced by system integrators and value-added resellers (SI, VAR). 70% of big data and advanced analytics apps for manufacturing are created by enterprise and system integrator/value-added reseller (SI/VAR) development teams. The following graphic provides an overview of industries targeted by big data, segmented by developer segment.

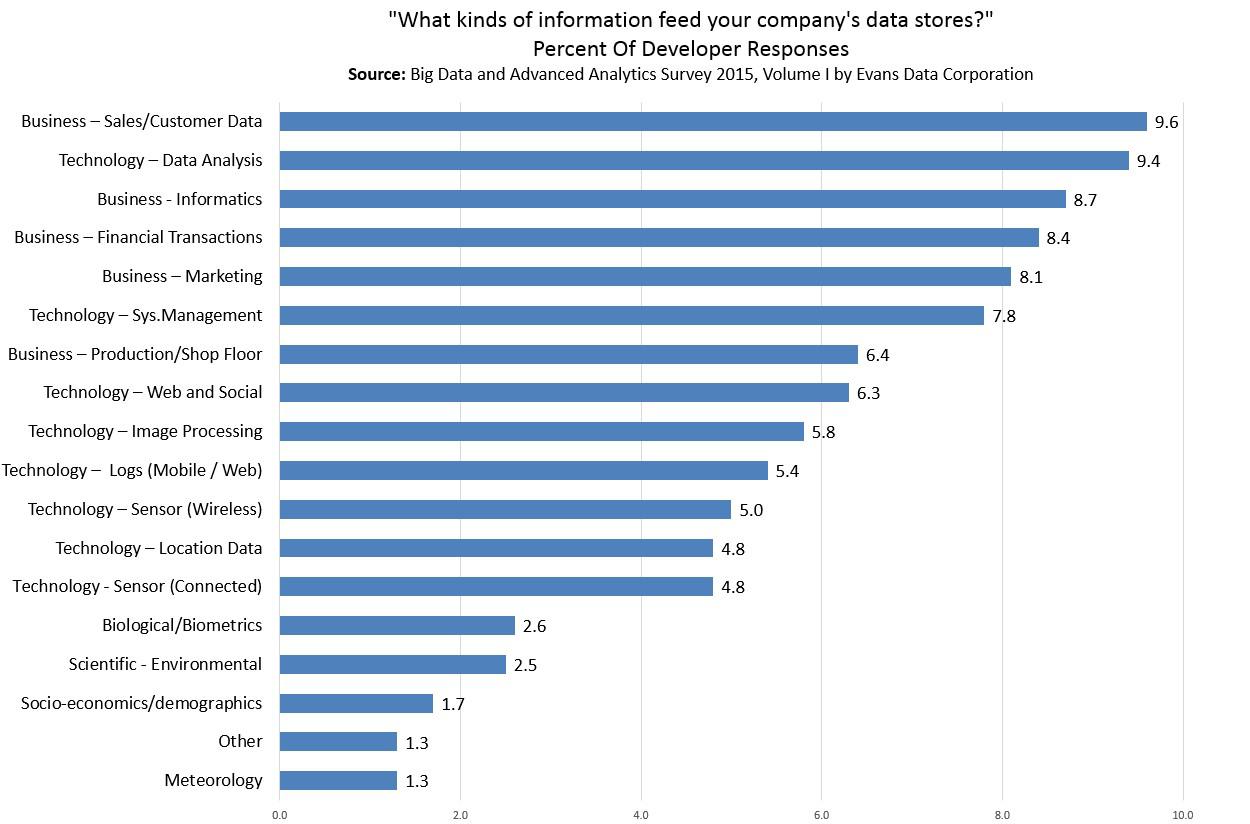

- Sales and customer data (9.6%), IT-based data analysis (9.4%), informatics (8.7%) and financial transactions (8.4%) are the most common big data sets app developers are working with today. In addition marketing, system management, production and shop floor data, and web & social media-generated data are also included. Evans Data found that informatics data sets grew the fastest in the last six months, and scientific computing is now competing with transaction processing systems as a dominant data set developers rely on to create new apps.

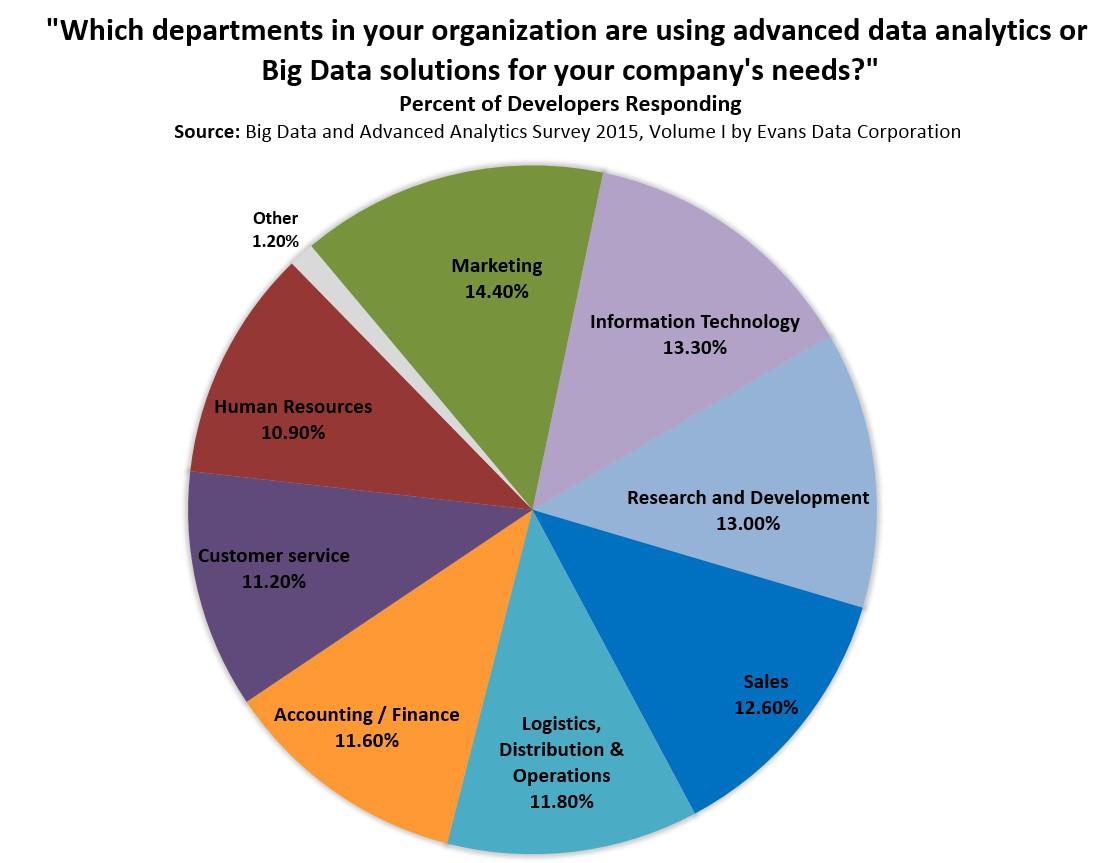

- Marketing departments have quickly become the most common users of big data and advanced analytics apps (14.4%) followed by IT (13.3%) and Research & Development (13%). Evans Data asked developers which departments in their organizations are putting big data and advanced analytics apps to use, regardless of where they were created. 38.2% of all big data use in organizations today are in customer-facing departments including marketing, sales, and customer service.

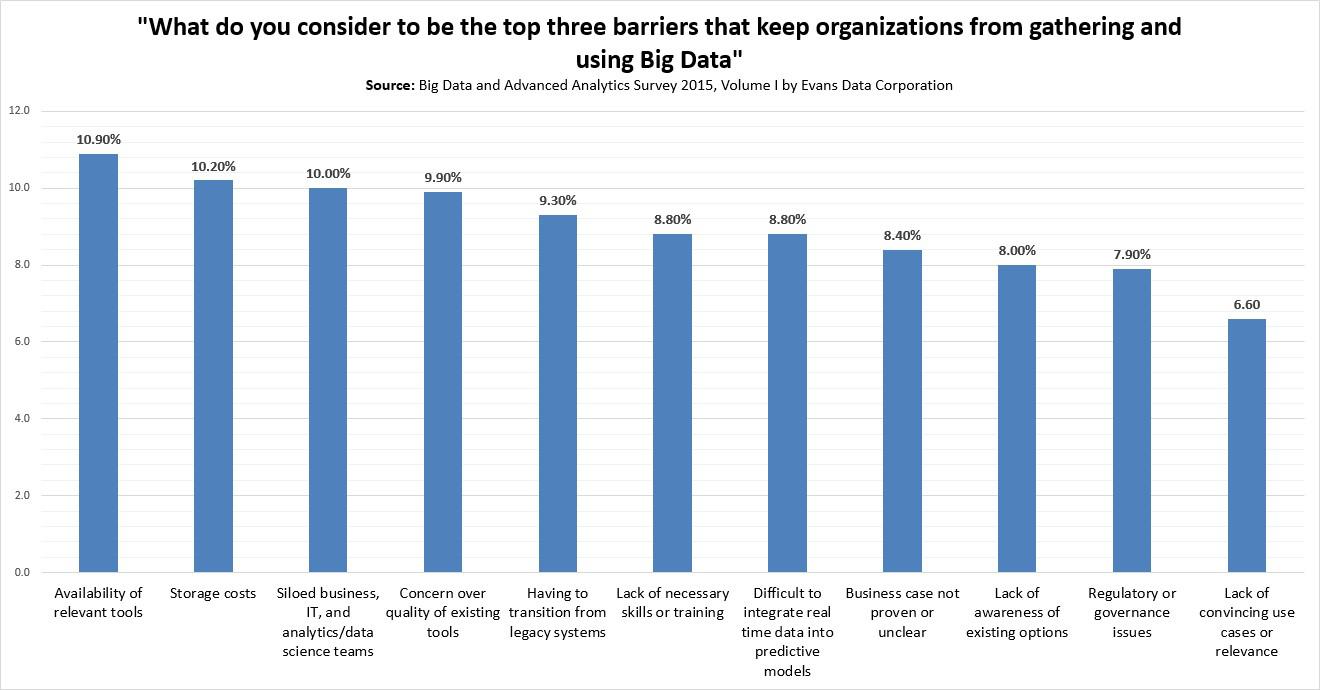

- Availability of relevant tools (10.9%), storage costs (10.2%) and siloed business, IT, and analytics/data science teams (10.0%) are the top three barriers developers face in building new apps. It’s interesting to note that compliance and having to transition from legacy systems did not score higher in the survey, as these two areas are inordinately more complex in more regulated, older industries. For big data and advanced analytics to accelerate across manufacturing and financial industries, compliance and legacy systems integration barriers will need to first be addressed.

- Quality of data (19.2%), relevance of data being acquired (13.5%), volume of data being processed (12.6%) and ability to adequately visualize big data (11.7%) are the four biggest problem areas faced by big data developers today. Additional problem areas include the volume of data in storage (10.5%), ability to gain insight from big data (10.1%) and the high rate of data acquisition (7.6%). The remainder of problem areas are shown in the graphic below.

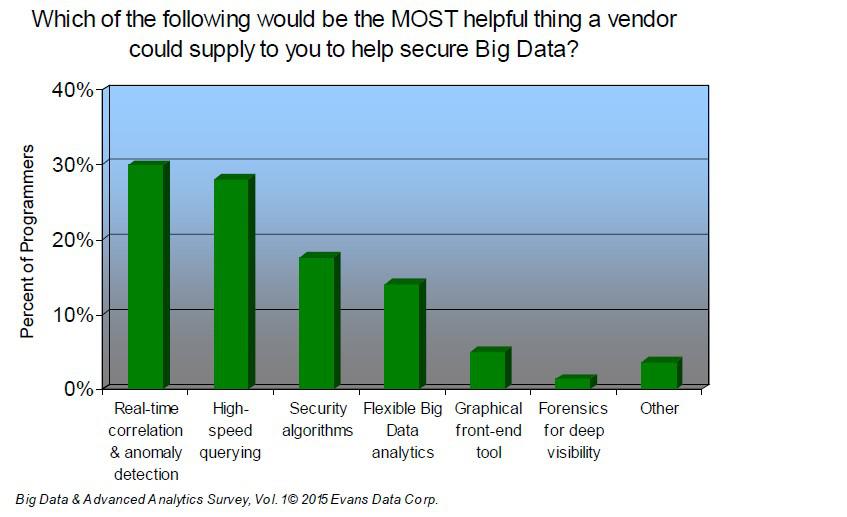

- Providing real-time correlation and anomaly detection of diverse security data (29.9%) and high-speed querying of security intelligence data (28.1%) are the two most critical areas vendors can assist developers with today. Big data and analytics app developers are looking to vendors to also provide more effective security algorithms for various use case scenarios (17.6%), flexible big data analytics across structured and unstructured data (14.2%) and more useful graphical front-end tools for visualizing and exploring big data (5.1%).